How automation makes insurance more personal

The insurance industry has never been a poster child for modernization, but there are very specific benefits to having an online customer journey. In this article, we break down how moving your application process can be easier, more secure, and attractive to potential clients. Senior Data Scientist, Jerry Thomas tells how.

Insurance is very people-y.

Ah, Life Insurance. The premise seems pretty simple – you pay a small amount per month to a company, who, upon your death, pays out a death benefit amount to whomever is named as beneficiary. Of course there are variables involved such as age, health status, occupation, and many more that affect whether a person is eligible for coverage. Insurers have to balance a person’s health with the risk of a sudden passing.

Traditionally the insurance business was very people-oriented, and still is in many ways. Advisors are there to help prospective clients navigate the application process, which can be long, convoluted, and involve collecting paperwork, possibly scheduling a physical exam, and signing a heap of documents. This used to be completed in living rooms or offices over the course of days or weeks. A relationship formed and the only thing that seemed to upset this whole apple cart was a highly infectious virus. Suddenly those relationships evaporated when face-to-face meetings were no longer thinkable.

Of course, this sent an entire industry into the unknown – how do you sell such personal products without people? Easy, we have the internet and it works like a charm.

Get more context for our vision of what’s coming: thinktum and the Future of Insurance.

Hello, modern insurance!

Car insurance has been sold online for at least 20 years without incident. Applicants love going online, and with a few clicks, they receive a quote. But it seemed the online leap from cars to life was just too vast for many organizations. That’s starting to change of course with the advent of AI and other data tools, now there are all kinds of insurance automation available – from fillable pdfs to fully automated customer experiences. We find most firms are in the grey area somewhere in between, with one eye on the future and the other clamped down hard on their bottom line.

The challenge is people are looking for a fast and efficient application process. One that they can hop on whenever it’s convenient and complete in a matter of minutes. One that doesn’t involve advisor visits, a doctor’s exam, or chasing down bloodwork reports. They’re looking for an online experience that will end with an affordable policy.

Concurrently, businesses are looking for optimized processes that will allow more conversions in less time. In many (fine, most) cases, underwriters are still reviewing applications to ensure they fit within the firm‘s risk appetite. But wouldn’t it be better to provide a truly powerful online user experience without the need for manual underwriting? One that delivers a fast and efficient process but has ample security, flexibility, and can be trusted to make a logical and business-friendly determination regarding a policy?

That’s where thinktum comes in.

For a deeper dive on the subject: Of Risk Appetite and Underwriting Philosophy.

Imagine, truly unbiased underwriting.

With most policy applications, regardless of whether they are offline or on, an underwriter will determine whether the applicant should be accepted based on their health information. In some cases, a cursory glance is all that’s needed to approve a policy, while in other cases, a determination is more complex and requires additional time, evidence, or contemplation. That’s fine. However, underwriters are still human (today, anyway) and they can be affected by internal and external issues, emotions, or company policy. Add on that many people hold inherent biases without recognizing them, and well, it seems like this system isn’t as accurate, foolproof, or fair as it can be.

What happens if you automate the underwriting process to remove that bias?

Well, two things: first, you will probably write more straight through business – the low-hanging fruit of insurance. Second, you provide prospective clients with what they are looking for – fast and easy customer experiences.

Underwriters on the other hand, finally have the time and attention to focus on applications that require additional scrutiny or follow-up. Or they can be deployed to design new products or services or focus their time following up with problematic applications. The people-y stuff.

See for yourself which tasks can be fully automated

| Task | Automatable? |

| Develop dynamic questions as part of the customer journey. | Yes |

| Verify confusing or conflicting answers. | Yes |

| Provide behavioral data and alerts. | Yes |

| Underwriting completed. | Yes |

| Determination & recommendation made. | Yes |

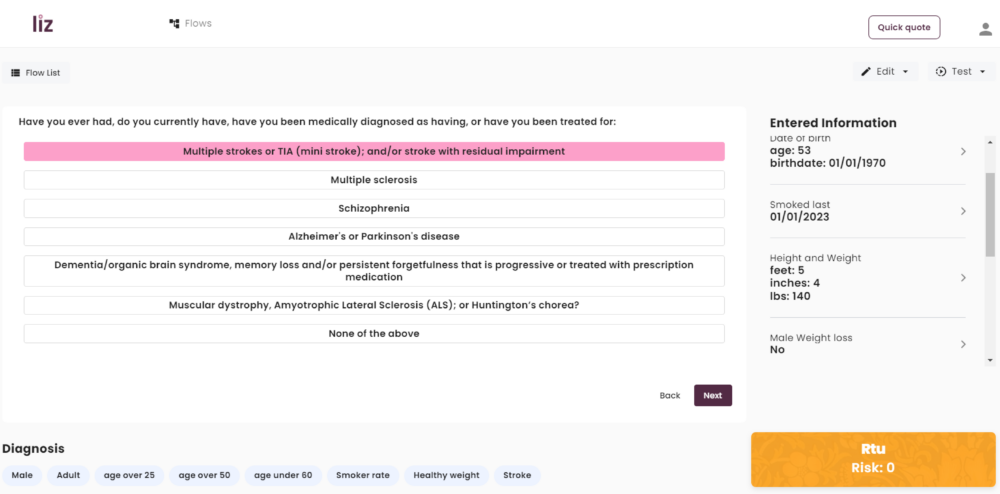

You see, effective, modern technology doesn’t second guess, hope for the best, or just squeeze something through. If the policy fits within the underwriting philosophy, it will be approved. Every customer journey will end with one of three possible messages: approved, denied, or referred to underwriting (RTU). This minimizes that grey area drastically. Don’t worry, third-party data sources such as MIB can be easily incorporated for added verification and security.

So how does it all work? How can software recommend a decision on whether a person qualifies for insurance or not? That’s simple, the answer is data.

And to find out how exactly, we asked our featured collaborator, Jerry Thomas, to develop.

As a data scientist, I’ve witnessed firsthand how the analysis of Big Data helps in precise determinations in Life Insurance. Using advanced algorithms and predictive models, AI harnesses the power of Big Data to discover risk profiles, accurately forecast mortality probabilities, and tailor coverage to individuals’ unique circumstances. By analyzing policyholder data, medical records, claims data, social media activity, and more, the AI models gain a holistic view of applicants and policyholders, enabling more accurate risk assessment.”

At the heart of the matter are many technology providers – including thinktum – using artificial intelligence, machine learning, or deep learning (AI, ML & DL) to better predict the future. Looking back is no longer adequate, yet we need that historical data to better understand what happens tomorrow or next month or year. Past data affects how powerful and accurate future decisions will be. You have to be quite creative and knowledgeable to predict the future! We need past data, scientists, and technical know-how to better forecast future circumstances.

Here’s how Jerry explains it.

Historical data is a valuable resource for AI in predicting the future in life insurance.

Here’s a breakdown:

- Pattern Recognition

AI models can recognize relationships between variables such as age, health conditions, lifestyle factors, and claims history and can predict the likelihood of specific events or risks occurring in the future.- Risk Assessment

By analyzing historical data on mortality rates, medical records, and policyholder information, AI models can help insurers make more accurate predictions about policyholder mortality and adjust premiums accordingly.- Predictive Modeling

By training on large volumes of past data, AI models can forecast factors such as policyholder behavior, lapse rates, claim probabilities, and long-term policy performance.- Customer Segmentation

AI models can segment policyholders into distinct groups based on various attributes and develop personalized insurance offerings tailored to their specific needs.- Fraud Detection

By analyzing past instances of fraud, the AI algorithms can detect and flag suspicious claims or behaviors, helping insurers combat fraud more effectively.- Portfolio Optimization

By analyzing past policy performance, claims data, and market trends, AI models can recommend adjustments to the portfolio mix, ensuring a balance between risk and profitability.”

But how is more personal?

Simple. Every question beyond the initial age and gender depend on the answers previously provided. This eliminates any grey areas because the system doesn’t allow them. Grey areas are trouble when it comes to people’s health and finances. The best part is no two customer experiences will ever be alike because no two customers are alike either. Questions are asked using natural language and are dynamic, meaning they adapt to the previous answer and the system automatically addresses incomplete answers, or conflicting information. It instantly clears up and resolves those grey areas with the client, eliminating the need for manual underwriter follow-up, allowing faster and better user experience and more straight-through business. To be clear, this step is about verification. See for yourself.

We promise tailor-made recommendations.

With thinktum and the liz suite comes the experience people (organizations, advisors, and applicants alike) are looking for. Everyone knows that when you get exactly what you want, it’s a relief. When it happens quickly and easily, it’s like winning the lottery! The trouble is people may not know what insurance product is right for them when so many exist in the marketplace. Our software ensures every customer experience is exactly pinpointed to their exact situation. Adding this layer of hyper-personalization to every application creates a frictionless customer experience, and for applicants that means delivering how and what they want, when they want it. We believe if something is obviously tailored for a specific person, they will recognize the value in that because it speaks directly to them.

That’s how automation makes insurance more personal.

Finally a viable solution!

thinktum and liz are revolutionizing the customer experience for the insurance industry. With the liz suite, business experts get:

- A faster, easier application process

- Logical and fast determinations

- Flexibility where they want it – control where they need it

- Unbiased underwriting means fewer problems and less unhappy clients down the road

We’re not saying that our liz suite will solve all of an insurer’s problems; but we’re pretty confident in saying that if you book a short demo with us, you’ll be pretty impressed with what you see.

We’ll also answer any questions you may have about liz, our customer experience or how hyper-personalization gives people what they want.

For more on creating personalized experiences, read Hyper-Personalization Paves the Road to Success.

We’d love to get your opinion on our technology! Reach out to us and book that demo today.

This article’s featured collaborator

|

Jerry Thomas, Data Scientist |

Jerry Thomas, Data Scientist |