Give thinktum another month

In our first installment, we discussed how easy it is to implement and deploy a liz module in a single month. It’s no surprise we’re now speaking about another month and another module, but it’s all true. Two liz modules working together really can completely change everything about your user journey. Here’s how.

Let’s catch up

Welcome back! In our previous story in this series, Give thinktum a month, we presented how thinktum can deploy one of our vigorous liz suite modules – either liz flow or liz assess – to transform an organization’s user journey in a single month. Yes, even February! Then, a month later, thinktum will deploy a second module from the suite. And in our next installment, we’ll discuss deploying our third module, liz data. An entire technology suite implemented and deployed, all in a single quarter of a year.

To catch up anyone needing it, in our first article of Give thinktum a Month, we discussed how it’s always faster to deploy our technology than it is to secure an initial meeting with insurance executives to ascertain their needs. And no, we’re not being hyperbolic.

thinktum’s modular technology can be fully implemented and deployed within 30 days, and that’s because it simply sits on top of an existing technology infrastructure. So, now that you know you can get something installed in a month, let’s define the modules.

Reduce costs while increasing organizational capacity & the quality of business with liz.

Say hello to liz

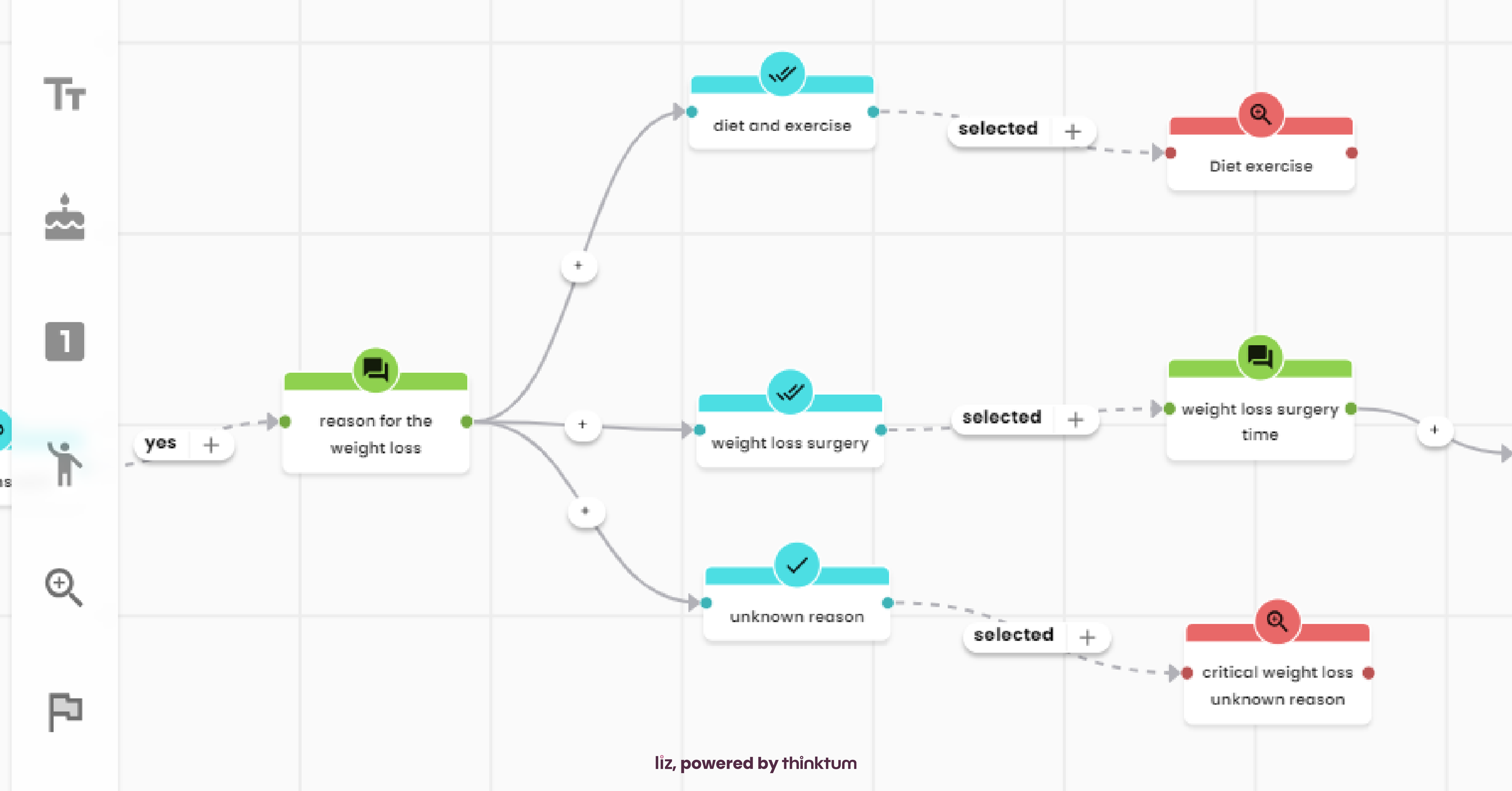

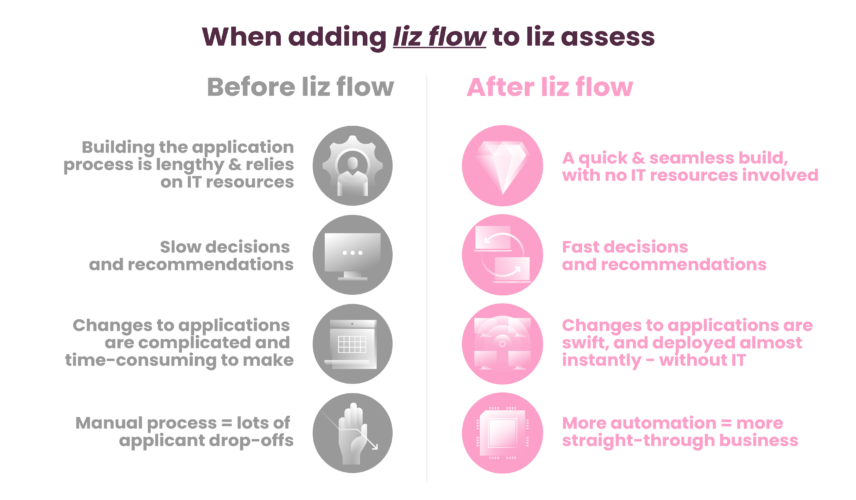

liz flow is our editable canvas (or e-app). It allows for anyone with the granted authority in the business to go in and change whatever, whenever it’s required. They have full control to add, copy-paste, or delete flows; add, edit, or delete questions, or even change the order of questions in the sequence. If it turns out a single question is allowing in too much, or bad risk, you have the power to change it up and close that gap. No emails, meeting requests, eye-rolls, or written justification required.

Adding on liz flow allows for 3 times faster technology integration and deployment.

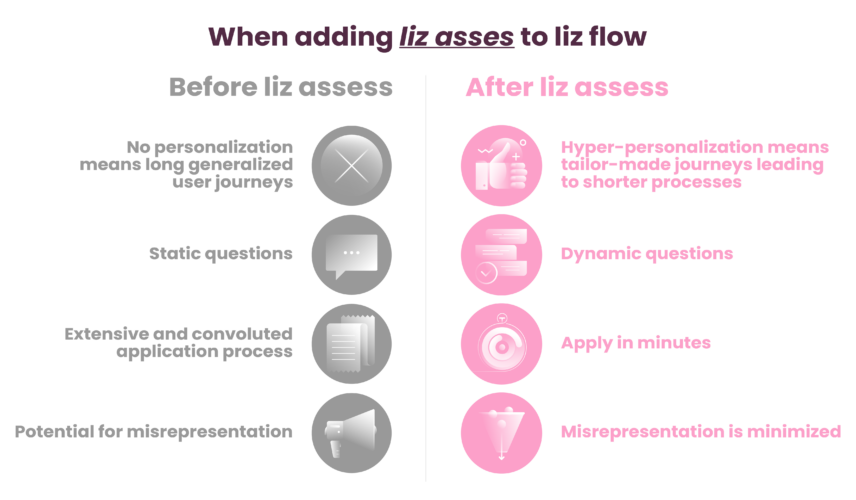

liz assess is our hyper-personalized underwriting rules engine. It delivers the fastest and most accurate risk assessment to an applicant’s user journey, allowing more straight-through business. liz assess really provides the most relevant decision-recommendations out of a tailor-made underwriting process. The language used is easy to understand and if any incongruous answers are provided (for whatever reason), liz will automatically begin softly asking follow-up questions until the incongruity is resolved. This allows applicants greater opportunity to make a full and honest disclosure, cutting down on misrepresentation and fraud. Of course, you can also add on third-party data sources for additional verification and security.

No two applications will ever look the same because no two people are the same; and no one wants to complete a dense and likely overly-complicated 45-page paper application anymore. And why should they?

Adding on liz assess means Increased percentage of business processed straight-through, with maximized honest disclosures.

Does it really only take a month?

Short answer is yes. The long answer is also yes.

We don’t mean to be flippant, but that’s the reality. An organization could implement liz flow in month one, and then move on to liz assess the following month. That one-two punch of liz flow and liz assess is pretty impressive. With these two modules working together, they would have both editing functions as well as the ability to put through more straight-through policies. Underwriters are finally getting the kind of freedom of control they’ve been dreaming of for years (and years). Applicants will love the hyper-personalization and fast application journey. They will also appreciate the natural and everyday language used. No more navigating paper applications with a dictionary to avoid answering untruthfully while your blood pressure rises slightly with every confusing question.

Organizations get to decide

Now, to be clear, it doesn’t even need to be another liz module. An insurer could do without and add on a new product line (as they’ll now have all they need to do so). Whatever you need is what we deliver because we spend time digging deeper into what the industry truly needs, where the risk gaps lay, and what the long-term goals are. Whichever module you decide to implement when, our business experts collaborate closely with our partner organizations to ensure staff is confident and competent with using our software before it’s deployed. They have the entire month to learn the ropes, feel around, and get their feet wet. By the time deployment occurs, most business users are chomping at the bit to get the liz modules up and running.

However, should you make the wise call of implementing a second liz suite module, the business will see significant improvements after deployment.

But that’s not all they see. Most systems are ‘black-box tools’, meaning they don’t allow you to see what’s happening within them, especially when AI-driven components are involved. Our liz suite ensures every part of the module’s workings are always completely visible to the business. If an applicant is declined coverage, an underwriter can go into the system and provide the exact reason for the declination. This gives applicants and insurers a valuable tool, better customer service, and happier applicants.

Just think: 30 days could change an entire user journey trajectory for the better, forever.

Why wouldn’t an insurer want to know more about that? Our Clients page all the answers.

In our next installment of this series, we’ll explore what can be done in the third month and hoo-boy, wait until you see what can be done with the entire liz suite. It’ll knock your socks off!