Give thinktum yet one more month

Amazing things can happen in under 100 days. This is especially true when talking about how new technology can completely transform a user journey from time-consuming, paper – or even editable PDF-based applications to a hyper-personalized online experience that users love. Keep reading to get the facts.

Let’s catch up

Welcome to our third installment of Give thinktum a month. In our first article, we described how thinktum can implement and deploy a single liz suite module on a client’s infrastructure in just 30 days. In the second article, Give thinktum Another Month, we detailed how thinktum could implement and deploy a second liz suite module in just another 30 days. And today we’re speaking about implementing and deploying the third and final liz suite module.

This means, in 90 days, we can fully integrate and deploy the entire suite.

What happens during month three?

If you’ve been following along, you’ll know that we recommend beginning with deploying liz flow, our online canvas (or e-app) first. liz flow allows business users with the right credentials to go in and edit, change, add, or remove flows as well as individual questions. Our Pure no-code technology means business users can get started right away because of our intuitive interface, all without the need for IT resources to be even a little bit involved. Finally, the firm’s underwriters will have the control they’ve been craving for years! With liz flow deployed the business can now see how much value a single module has.

In the second month, we recommended implementing and deploying liz assess, our hyper-personalized underwriting engine. liz assess is responsible for providing decision-recommendations to applicants on whether they qualify for a policy or not. But it also re-routes questioning to the shortest possible path, all while making our user journey one that is frictionless and easy to navigate. Adding another module on during the second month allows the business to see just how exponentially valuable the modules are when working together.

Once a firm deploys the first two modules, the difference in experiences both for the business and their clients is astonishing. First, being able to edit and update flows is a huge boon to Underwriters; but end-users will also notice how fast the application process becomes. Every question asked is based on information already provided so they always make sense which provides a much more personal experience and allows applicants greater opportunity to be accurate.

With liz flow and liz assess, insurers have an opportunity to add on more products, update, and modernize their current user journeys in a way that truly speaks to applicants. Now, they can apply for the right coverage at any time of day or night on whichever device they fancy. And within just a few minutes, most people receive a determination. More straight-through business for the firm means a greater ROI and staff can spend their days on more creative and client-focused tasks.

Learn How thinktum’s technology can make insurance more accurate and trustworthy.

Meet liz data

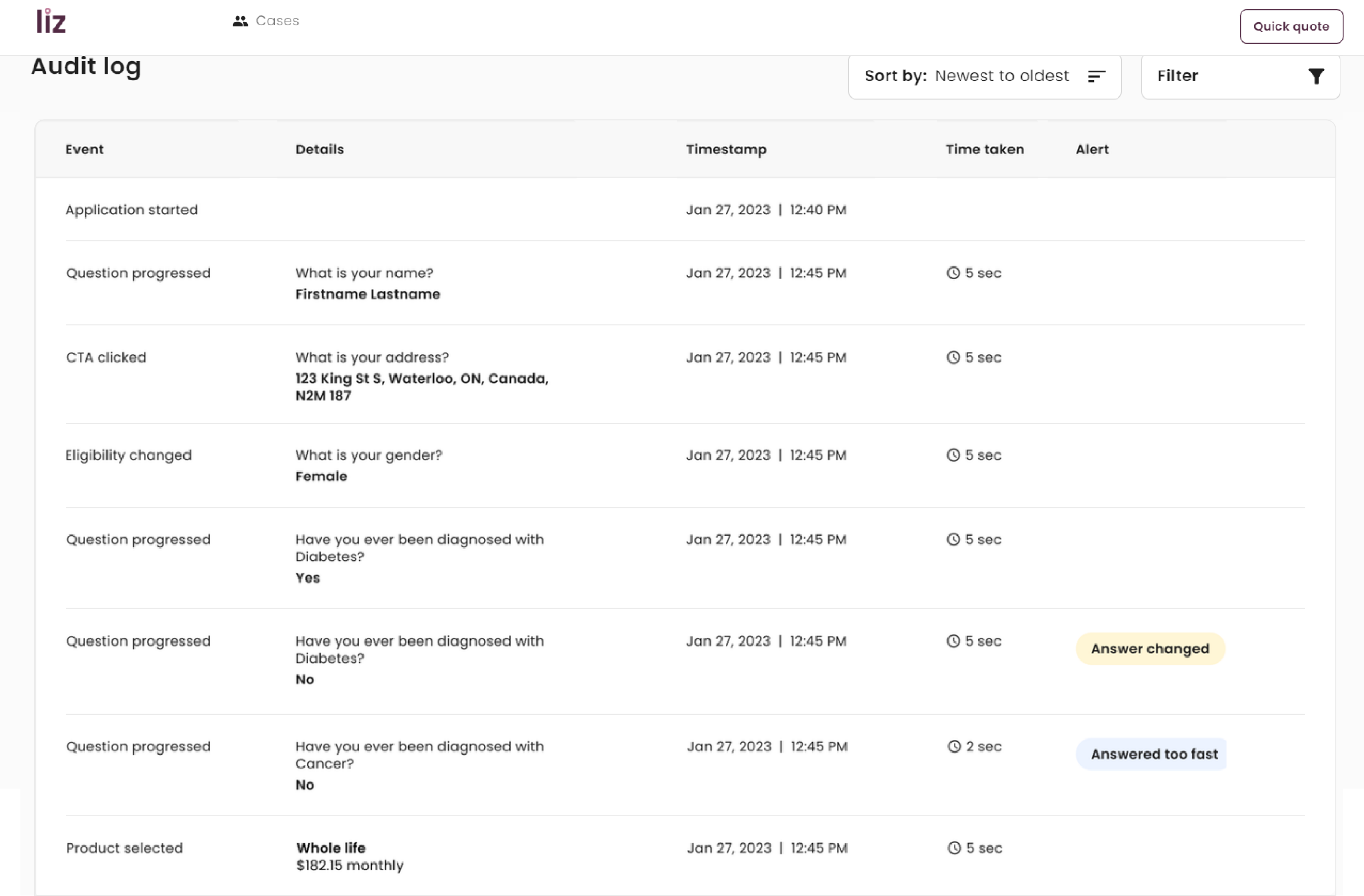

In month three, all that’s left to implement and deploy is thinktum’s liz data module. We consider this the brains of the operation. liz data has been designed as the AI-driven data collection and analytics module. It collects behavioral data from the applicant to provide real-time analysis and alerts. The data collected is provided to the business in an easy to see and comprehend dashboard.

No more having to cross-reference between different data feeds or platforms. We’ll discuss liz data’s specific powerful functionalities in future pieces but suffice it to say the data analytics provide unique 360-degree visibility into the system that traditional “black-box” systems just can’t deliver. liz was built as a glass box. It is fully transparent to allow the business to see what’s going on. A whole new level of information becomes available, and control is now in your hands thanks to Data collection & analysis, with instant optimization capabilities.

With the entire three-module liz suite implemented and deployed, firms now have the ability to future-proof their user journey, strengthen their sales & marketing pitches, as well as improve their product lines offering. Moreover, business growth will never be held up by unavailable IT resources since none are needed with the liz suite.

liz data has been designed and developed to benefit the organization, while we developed liz flow and liz assess to focus on improving the customer journey and supercharging underwriting capabilities – which will thrill both applicants and business users.

Now, let’s see some data.

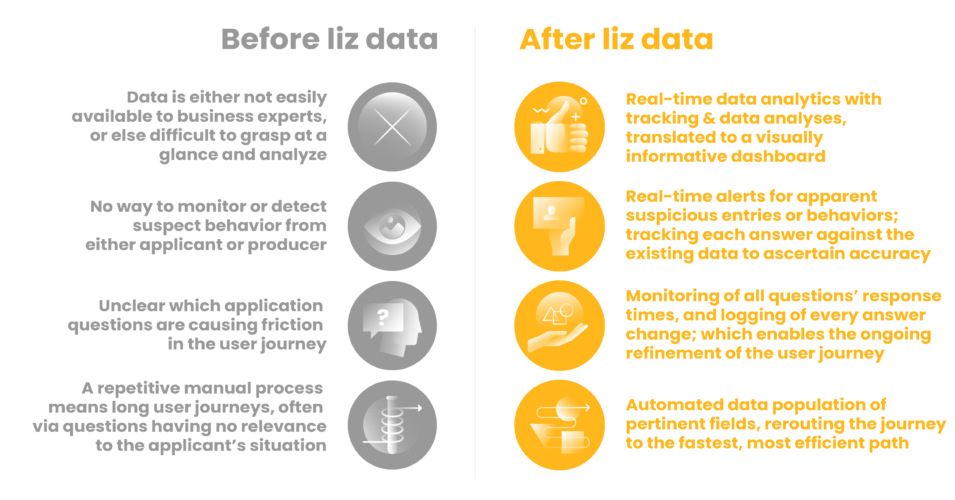

Adding the third module on, liz data, really allows the insurer the ability to collect, store, analyze, and fully optimize the user experience. The advantages of adding liz data on are obvious, but let’s recap, nonetheless.

This module:

- Organizes data.

- Auto loads data already supplied into pertinent fields.

- Tracks each answer against the existing data to ascertain accuracy.

- Reroutes the journey to the fastest, most efficient path.

- Automatically transfers any data to internal/external databases as required or designed.

Vigorous analysis in a single dashboard

The data analytics possible with liz data will blow your mind.

They provide:

- Real-time data analytics, tracking & data analyses, translated to a dashboard that provides information visually.

- Real-time alerts for any apparent suspicious entries.

- Monitoring of every question’s response time.

- Logging of every answer change.

- Dashboards on new business trends (for example, revenue), as well as products and risk trends (for example, Guaranteed Issue vs. underwritten products).

- New product launch trends (like annual average age comparison, ratable risk per age segment, or revenue & face amounts trends).

Finally! With the entire liz suite at your fingertips, the control acquired by the business is second only to the new, fast, and frictionless user experience that is now your offering.

Everyone gets what they want with liz and the business can completely renovate, recharge, and rework their user journey in just 90 days.

The Power of data analysis using AI-driven components provides valuable insight.

All liz, all the time

With the liz suite, every part of the user journey is transformed. Better questions lead to better answers, and better answers provide a clear snapshot into the applicant’s current health.

With the information supplied from liz data, our editable e-app canvas can be tweaked and made more and more efficient. And liz assess takes that efficiency and runs with it! From rerouting questions to gentle follow-up queries for assured accuracy, liz assess guarantees misrepresentation can’t achieve a toe-hold. Any purposefully inaccurate responses are caught and reported as an alert well before a final determination is made, safeguarding the firm and the applicant.

End-users aren’t interested in completing long or paper-based insurance applications anymore. They want the convenience of an online application so they can have more independence as clients. They appreciate the everyday language used that improves accessibility and increases the likelihood of an applicant successfully completing the application. They aren’t leaving the process before the end because of confusion or because it’ll take too much time.

Advisors are no longer relegated to setting up sessions to fill in applications with prospective buyers. With a shorter, and more frictionless user experience, applicants should be flocking to the business’ site to apply. The liz suite also ensures follow-up calls and meetings, doctor’s visits, and other medical appointments aren’t required either. More straight-through business means Advisors can focus their attention on developing business elsewhere in the organization.

Underwriters will see the most change, however. From manually underwriting most applications to allowing liz assess to do it means they can spend less time playing medical detective and more time developing new products, assisting customer care agents in call centers, or completing manual underwriting on complex or difficult cases that require extra validation.

All of these changes are possible with the liz suite. And as new modules come on board every month, it gives the business ample time to get staff trained up to use them before deployment. Frankly, spending an hour or two just poking around is usually all that’s required as a training ground because of the built-in logic and intuitive features the suite offers.

Contrast all that with more traditional underwriting and you’ll instantly see the difference. Old school or traditional Underwriters looked at hundreds of completed applications on the hunt for misrepresentation, checking medical documents, and making decisions based on the firm’s risk appetite. Some still do!

With liz, so much of the checking, verifying, and evidence-gathering happens automatically within the system, they simply aren’t to-do items anymore. That’s not to say that Underwriters will no longer be required. Just the opposite! They’ll be doing more higher-level tasks, along with interesting and creative things elsewhere within the organization, maximizing their impact on the business.

Gain valuable insight on our liz showcase page on LinkedIn.

At the end of the day

With thinktum’s liz suite installed, applicants are just happier – they have easy access to great products and can sign up fast and from whichever device they prefer. This kind of self-directed freedom is very attractive these days for most people used to purchasing online.

The insurance firm is happy too – applicants can apply and be approved with less time and attention from humans. That frees the people up to leverage skills only humans master. Better customer service for everyone, more attention to clients who need it, better value to their organizations through ideas, new products, and resources bandwidth to hop on new projects or initiatives.

Underwriters are happy because they finally have what they’ve been looking for – control.

The bottom line

A more efficient application process allows more people through it. More applications in means a higher chance of more new business. This is especially true with a painless application process.

Happier customers who can get better coverage with less effort means they may purchase more, and will definitely tell their loved ones where to go to dodge a “nightmarish application process”. This also allows staff more time to look after customers and queries which increases clients’ delight. This, paired with insurance staff doing more rewarding and creative work can have a positive net effect on an organization’s sales, service, and brand.

Three months is enough time to revolutionize your entire process.

A company can achieve a 180-degree turnaround during this short period of time. Today is the best day to begin a conversation with us. To get started, let’s talk.